#EconomicPolicy

#EconomicPolicy78

Contacts:

Saleem Bahaj: s.bahaj@ucl.ac.uk

Sophie Piton: Sophie.Piton@bankofengland.co.uk

Anthony Savagar: a.savagar@kent.ac.uk

Booming entrepreneurship during the covid-19 pandemic

Evidence from the UK

Typically recessions discourage entrepreneurs from starting new businesses: for example, during the Great Recession of the late 2000s, a ‘generation’ of start-ups went missing, which contributed to a slow recovery in employment. But evidence for the UK two years after the pandemic started suggests a very different story: the pandemic inspired many entrepreneurs to start new businesses. But these firms exited quickly, posted few jobs and grew less, so the overall impact on employment was limited.

These are the findings of new research by Saleem Bahaj, Sophie Piton and Anthony Savagar. Their study indicates that the rise in firm creation was driven mainly by first-time solo entrepreneurs – single individuals who had not started another business in the five years prior to the crisis. Such entrepreneurs hire fewer employees than other groups, and those registered during Covid-19 were even less likely to become employer firms, more likely to dissolve and less likely to grow. These negative channels more than offset the booming number of these firms.

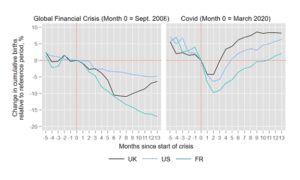

Figure 1 shows the contrast between the Great Recession and the pandemic in terms of their impact on business creation in the UK, the United States and France. It plots cumulative applications since the start of the crises, relative to a reference pre-crisis period. The reference period for the Great Recession is September 2006 to 2007 and for the pandemic is March 2018 to 2019.

During the Great Recession (left panel), 12 months into the crisis, there were 8% fewer business registrations at Companies House than pre-crisis. By contrast, 12 months into the pandemic (right panel), new registrations were 8% higher than pre-pandemic. This stark contrast between the Great Recession and the pandemic is not specific to the UK. There are similar trends in France and the United States.

The new study looks at these new entrepreneurs and analyses their effect on aggregate employment.

Figure 1: Cumulative business creation relative to pre-crisis – the global financial crisis (GFC) versus the pandemic for the UK, the United States and France.

Source: Authors’ calculations using Companies House, US Census and INSEE.

A start-up boom in online retail and by first-time entrepreneurs

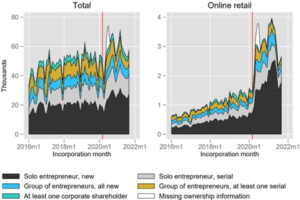

UK business registrations exhibited a sharp decline followed by a rapid rise after the introduction of the first national lockdown in March 2020. Before the pandemic, there were roughly 50,000 monthly registrations in total and this increased to 60,000 after March 2020.

The online retail sector disproportionately contributed to this increase: despite the sector’s modest size in the total number of firms (2%), it contributed up to 2,000 of a total increase in 10,000 registrations per month. In other words, online retail accounts for 20% of excess entry during the pandemic.

The researchers have investigated who started firms during the pandemic. When registering with Companies House, firms have to provide information on their shareholders and respective stakes. Using this information, the study identifies whether the firm is owned by another corporation or individual shareholders, and whether the shareholder has stakes in other companies as well.

Intuition might suggest that existing firms quickly adjusted to set up online retail subsidiaries or benefit indirectly from business support packages. But the researchers do not find evidence for this.

Using the ownership information, they find that the rise in firm creation was driven by first-time solo entrepreneurs (Figure 2). First-time solo entrepreneurs are firms started by single individuals who had not started another business in the five years prior to the crisis or did not own a business when the pandemic started. This suggests that workers in lockdown pursued new ventures given more labour hours from reduced commuting or being furloughed.

Figure 2: UK business creation during the pandemic by ownership type.

Note: A new entrepreneur is an individual shareholder with no business active in Jan. 2020 or founded since 2016. A serial entrepreneur is an individual shareholder who owns a business active in Jan. 2020 or owned a new business founded since 2016. Solo entrepreneur refers to a firm with a single individual as a shareholder. Source: Authors’ calculations using BVD-FAME.

Entrepreneurs adjusted quickly to the collapse in retail footfall

The surge in business creation during the Covid-19 recession is surprising from a historical perspective. Entrepreneurship declined in most recessions over the past century in the UK, except in extreme event recessions, such as after world wars and the pandemic.

These recessions share the feature that the economy restructures to substantial shifts in consumer demand and producer supply. The post-war recessions in 1919 and 1946 saw entry boom as wartime production declined and private enterprise restarted. Similarly, during the pandemic, widespread lockdowns reallocated demand to sectors that complied with social distancing.

To understand the mechanisms behind the rise in business creation, particularly the rise in the online retail sector, the study investigates the relationship between business creation and movements to retail locations (that is, retail footfall) at the weekly frequency. Footfall is a good indicator of lockdown stringency and reflects changes in lockdown policies.

The researchers find that a decline in retail footfall leads to a rise in firm creation. They interpret the result as a negative demand shock to brick-and-mortar retail leading to reallocation of demand to other businesses, and a response in supply through firm creation. They show that business creation increases following a decline in footfall, and the increases are largest 10 weeks after the footfall decline.

This result highlights the rapid self-correcting mechanism of the economy during Covid-19. There were no direct policies targeted at new firm creation, and policies such as furlough, eat-out-to-help-out, and the bounce back loan scheme all required firms to exist prior to the crisis. Despite this, the study observes a quick reaction by entrepreneurs in the economy responding to demand changes and increasing supply in lockdown-compliant sectors.

These new firms are more likely to exit and less likely to post jobs than pre-pandemic firms

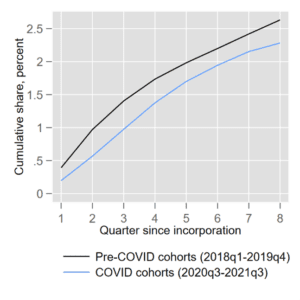

Are the new firms seeking to hire workers? To answer this question, the research matches Companies House data with job posting data from Indeed. Posting a job signals a firm’s intention to become an employer-firm. The authors study the speed at which new firms post jobs and find that firms created pre-pandemic post faster than firms created during the pandemic.

This is reflected in Figure 3, left panel, which shows the cumulative quarterly share of new businesses posting a job in Indeed in their first eight quarters after incorporations, for cohorts of firms born during versus before the pandemic. Firms born during the pandemic are less likely to post a job within the first year of their existence than firms born in the two years prior to the crisis (the blue line is significantly below the black line).

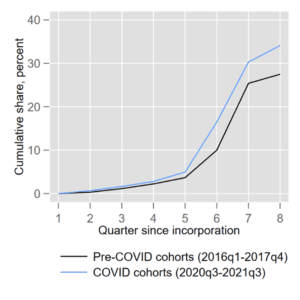

Are the new firms more likely to exit? Analysing the survival rates of new firms during the pandemic using dissolutions data from Companies House, the researchers find that firms created during the pandemic are more likely to dissolve than firms born pre-pandemic firms.

This is reflected in Figure 3, right panel, which shows the cumulative quarterly share of new businesses dissolving in their first eight quarter since incorporation, for cohorts of firms born during versus before the pandemic. Newly created firms during Covid-19 are more likely to dissolve within the first two years than newly created firms pre-pandemic (the blue line is significantly above the black line).

Figure 3: Firms born during the pandemic are both less likely to try to hire and more likely to dissolve.

Probability to post a vacancy Probability to dissolve

Source: Authors’ calculations using Indeed and Companies House.

Limited impacts on employment

The researchers map their observed facts into a statistical framework to estimate the aggregate effect of entry on employment. Their framework divides employment changes into four channels relating to their stylised facts: registrations of new firms; conversion of registrations to employer firms (that is, job postings); dissolutions; and firm employment size changes.

The framework shows that despite the surge in business registrations, new firms generated fewer jobs in their first two years than firms born pre-pandemic.

As a final exercise, the researchers apply their statistical framework to individual ownership types and industry structure. The aim of this exercise is to understand the implication of changing industry and ownership composition during Covid-19.

The application shows that the change in ownership composition contributes more negatively to employment creation than the change in industry composition, though both led to declines in employment creation relative to before the pandemic.

Surprisingly, the ownership type that experienced a significant boom in firm creation – new solo entrepreneurs – contributed to the negative employment effect. This occurred because the new solo entrepreneurs hire fewer employees than other groups, and those registered during Covid-19 were even less likely to become employer firms, more likely to dissolve and less likely to grow. These negative channels more than offset the booming number of these firms.

Business Creation During Covid-19

Authors:

Saleem Bahaj (University College London and Bank of England)

Sophie Piton (Bank of England and Centre for Macroeconomics)

Anthony Savagar (University of Kent and Centre for Macroeconomics)