#EconomicPolicy

#EconomicPolicy74

Pressures to Make Central Banks Independent

New cross-country evidence on the political economy of reforms of monetary policy authorities

While central banks have become increasingly more independent over the last five decades, there is still a large variation across regions. New research by Davide Romelli (Trinity College Dublin) investigates what drives the timing, pace and magnitude of legislative changes in central banking for a set of 155 countries over the period from 1972 to 2017.

The results show that countries with lower levels of central bank independence or those that are further from their regional average are more likely to adopt reforms that increase independence. External pressure to reform also comes from international institutions: countries that are receiving an IMF loan or joining a currency union adopt reforms to increase the independence of their central banks.

Reforms that increase central bank independence also follow periods of high inflation rates. But other types of crisis, such as systemic banking crises, currency or sovereign debt crises, are not followed by reforms of that kind.

There are also differences according to a country’s the level of development. For example, government fractionalisation, cabinet changes or economic growth matter for the reform process among advanced economies; while external pressures and inflationary episodes are more important in developing economies

More…

What explains the worldwide changes in central bank design over the past five decades? The four decades prior to the global financial crisis of 2007-09 were characterised by significant changes in the institutional design of central banks around the world, generally towards assigning monetary authorities a higher degree of independence from the executive branch.

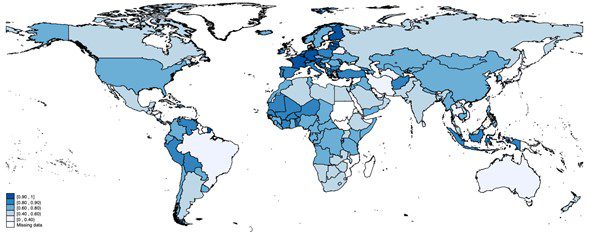

But despite the broad consensus on the optimality of this institutional arrangement in stabilising inflation rates, the degree of central bank independence still varies considerably across countries (see Figure 1).

Moreover, the decade since the financial crisis has seen a new wave of reforms concerning, among other things, the involvement of central banks in financial supervision. In recent years, the autonomy of central banks has also come under pressure, particularly in countries with populist political movements.

A considerable body of work has investigated the consequences of assigning more independence to monetary policy authorities. But the causes of reforms in central banking have received less attention.

The new study investigates why and how central bank reforms come about. To do so, the author introduces a large cross-country database on the timing of legislative changes in central banking for a set of 155 countries during the period 1972-2017. He constructs a dynamic measure of central bank independence that allows for a more precise determination than previously possible of the timing and magnitude of reforms in central bank design.

Employing this index, the study provides a comprehensive overview of the evolution and timing of reforms in central bank design around the world. While central banks have become increasingly more independent over the last five decades, there is still a large variation across regions.

The author then uses a political economy framework to identify five sources of reforms:

- status quo bias;

- external inducements;

- crises and shocks;

- ideology and political factors;

- and economic conditions.

The results show that the lagged level of central bank independence or status quo, as well as regional pressures are important in the reform process, as countries with lower levels of independence or those that are further from their regional average are more likely to adopt reforms that increase their level of independence.

An external pressure to reform also comes from international institutions, as countries receiving an IMF loan or becoming a member of a currency union adopt reforms that increase the independence of their central banks.

Reforms that increase the level of central bank independence also follow periods of high inflation rates, suggesting central bank institutional design is endogenous to the inflation dynamics of a country. On the other hand, other types of crisis, such as systemic banking crises, currency or sovereign debt crises, are not followed by reforms that increase the level of central bank independence.

The data also show important heterogeneities depending on the level of development. For example, government fractionalisation, cabinet changes or economic growth matter for the reform process among advanced economies, while external pressures and inflationary episodes are more important in developing economies.

The results reinforce some widely held conclusions, such as the importance of external inducements in reforming central banks, but they also shed light on some ambiguities in previous research, such as the role of crises. The new index not only sheds light on the endogenous evolution of central banks, but also provides a useful time-varying instrument of institutional design.

Figure 1: Central bank independence around the world in 2017

Source: Romelli (2021)

‘The political economy of reforms in central bank design: evidence from a new dataset’

Authors:

Davide Romelli (Trinity College Dublin)